July 9, 2018

A Targeted Economic Boost: An Expanded Working Families Tax Credit in Virginia Would Strengthen Communities and Families

A targeted working families tax credit can help families earning low wages meet basic needs. For families struggling to make ends meet, these tax credits make a difference in terms of putting food on the table, affording child care, and staying current on utility bills. These tax credits usually take the form of an earned income tax credit (EITC). The federal EITC is one of the biggest success stories we have. The credit lifts 3 million children out of poverty each year. Here in Virginia, it helps to support over 600,000 working households across the commonwealth.

Twenty-nine states and the District of Columbia have enacted their own state EITCs to supplement the federal credit. Virginia’s state EITC began in 2006 and is available to workers who claim the federal EITC on their tax returns, equaling 20 percent of the value of the federal EITC. Like the federal credit, Virginia’s credit rewards and encourages work, gives a boost to families, and improves the long-term prospects for children.

But the current structure of the state EITC leaves between $188 and $260 million in help on the table each year. That’s money that would give working people a wage boost at a time when wages are stagnant.

Virginia lawmakers have an opportunity to help Virginia’s working families by expanding the state EITC by making it refundable.

A Pro-Work Tax Credit

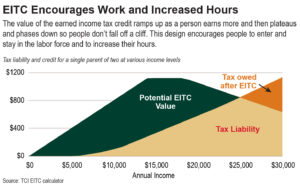

The EITC is structured to reward work, particularly for parents of young children. To qualify for the credit, a person must have income from working. The exact amount of a family’s credit depends on household income, marital status, and family size. Larger families and married filers are eligible to receive a larger credit. And the value of the credit ramps up as a person earns more and then plateaus and phases down so people don’t fall off a cliff. This design encourages people to enter and stay in the labor force and to increase their hours.

The Importance of Refundability

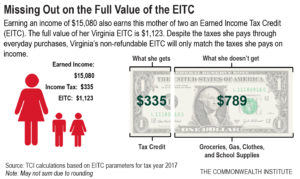

Like the federal credit, the state credit reduces a family’s income tax bill, with one key difference. At the federal level, if the value of the credit exceeds the amount of income tax owed, the family receives the difference as a tax refund. This is similar to how refundable tax credits for the state’s agricultural best management practices, film production companies, and research and development work. For people with low incomes, this refund helps to offset other taxes they pay, such as payroll and gas taxes. However, Virginia’s state EITC is not refundable. This means that if the value of the credit exceeds the amount that a family owes in state income tax, the family misses out on the full value of the credit.

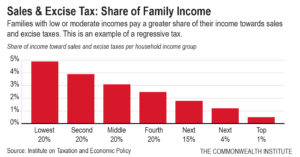

Refundability recognizes that, for low-wage workers, many state and local taxes take a larger share of their incomes than that of high-income and wealthy households. By lowering the relative share of taxes paid by families earning low wages, a refundable EITC would help Virginia’s working families cover basic needs and stimulate local businesses and local economies.

Supporting Our Economy

In the 2018 General Assembly session, lawmakers embraced business tax breaks as a strategy to revitalize communities that are facing economic challenges. This is an important goal, but business-centered tax cuts have, at best, a mixed track record of success in boosting the economy. By expanding Virginia’s state EITC through refundability, lawmakers could more directly address persistent poverty and improve the long-term economic outlook for communities by helping working families.

The EITC has strong pro-work features, boosting employment and work hours for low-income families. In addition, because low-income families spend more of their incomes locally on consumer goods, a stronger state EITC would lead to more local spending. For example, low-income families tend to spend a relatively larger share of their incomes on groceries and other basic needs. The additional disposable income and increase in consumer spending that would result from a refundable EITC would pump millions of dollars into communities throughout Virginia.

Research has documented the downstream and multiplier effects of this additional spending. Additional consumer spending associated with the EITC may spur additional business spending as well as other changes in income and spending patterns.

Long-Term Benefits

Over time, an expanded EITC could help communities address long-standing economic challenges by providing more opportunities for families and the next generation. Studies show the working family tax credits have a range of benefits — from improved infant health to increased college enrollment. Children whose families receive the EITC are shown to earn higher incomes in adulthood compared to similar children whose families did not receive the credit.

Workers earning low wages should be able to make ends meet and support their families. Refundable state EITCs are targeted policies that reward work and strengthen businesses and local economies. Refundability is a key improvement to provide families and communities with a hand up.