January 10, 2020

Accounting for Cars: Expanding access to driver’s licenses regardless of immigration status will help Virginia’s fiscal bottom line as well as helping families and communities

The main reason to expand access to driver’s licenses regardless of immigration status is because it makes our families and communities safer: safer from being unfairly caught up in the criminal justice system and deportation pipeline for just trying to get to church or a child’s school, and safer from being on the roads with unlicensed drivers who haven’t had the opportunity to access the state’s system of training and testing.

Yet expanding access to driver’s licenses will also make our communities and commonwealth more prosperous. Newly licensed people who are working could fill job openings far from public transportation that would otherwise remain empty. Agricultural employers could see an increase in the share of their workers who are trained, tested, and licensed drivers. Car insurance costs could go down for everyone if there’s increased road safety and decreases in the number of uninsured drivers. And as Virginia’s newly licensed drivers are likely to purchase or register in Virginia after passing Virginia’s testing standards and obtaining driver’s licenses, these drivers would further contribute to state and local revenues through the payment of fees and personal property taxes.

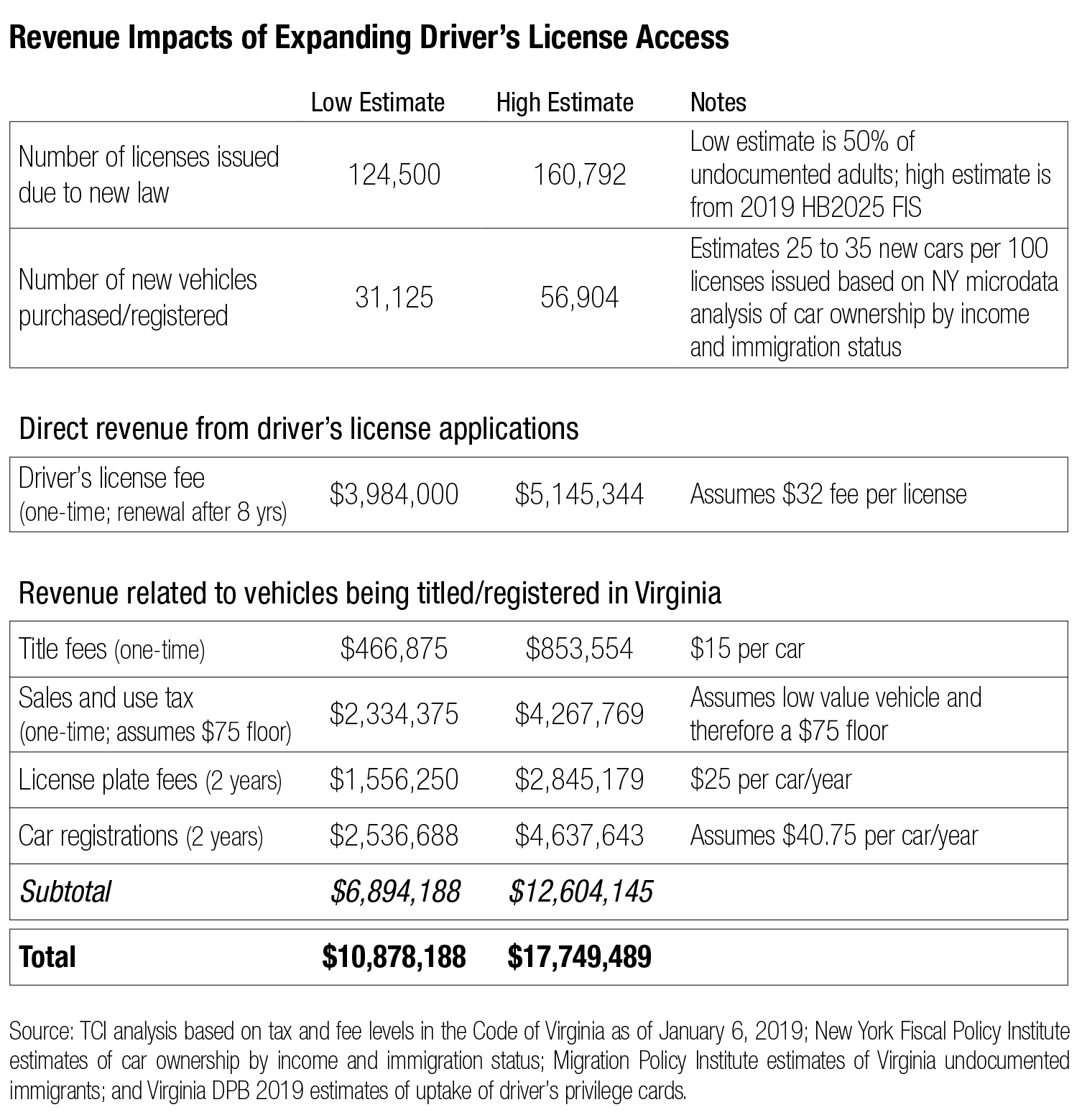

Using the experience of other states, the Virginia Department of Planning and Budget’s prior estimates, and analysis by the Fiscal Policy Institute, The Commonwealth Institute estimates that expanding access to licenses regardless of immigration status would result in between 124,500 and 160,800 newly licensed drivers within the first two years.

These newly licensed drivers would be more likely to own and register cars in Virginia, resulting in between 31,100 and 56,900 newly registered cars (this assumes access to lawful driving would narrow the estimated gap in car ownership rates between unauthorized immigrants and lawfully present immigrants of similar income levels; full methodology is included at the end of this report). And these newly registered cars would, in turn, result in Virginia collecting additional license plate fees, registration fees, title fees, motor vehicle sales and use tax, and local personal property tax revenue. Altogether, excluding the actual driver’s license fees, Virginia and its localities are likely to bring in at least $6.8 million in additional revenue during the first two years of implementation.

Driving is a necessity for most families, not a choice. Expanding access to licenses would help parents get to parent-teacher conferences, families get to church, and workers get to their jobs. Unauthorized immigrants are already a part of Virginia’s economy and communities, with many living in “mixed-status” families with lawfully present and U.S. citizen relatives. Access to licenses would not only help the individual unauthorized immigrant, it would also help their relatives and other community members. And it would help all of us live in a safer, more prosperous commonwealth.

Methodology

Number of newly licensed drivers

In other states that have recently expanded access to lawful driving regardless of immigration status, about half of newly eligible adults have applied in the first two years. Using that same share in Virginia, that would be about 124,500 newly licensed drivers. And in 2019, the Virginia Department of Planning and Budget estimated that 93,383 Virginians would apply for driving privilege cards in the first year that Virginia expanded access to lawful driving regardless of immigration status, and that another 67,409 would apply in the next year. Access to standard driver’s licenses regardless of immigration status would likely result in at least as many applicants in the first two years of implementation. Therefore, it is reasonable to expect that between 124,500 and 160,800 Virginians would be newly licensed within two years if Virginia expanded access regardless of immigration status.

Number of newly registered cars per 100 newly licensed drivers

Using microdata analysis of car ownership by income level and immigration status prior to New York’s recent expansion of driver’s licenses regardless of immigration status, the Fiscal Policy Institute (FPI) in New York found that, within each income range, car ownership rates per adult were substantially lower for immigrant households that include at least one unauthorized immigrant adult than for immigrant households where all adults have lawful immigration statuses. (This analysis was done separately for New York City residents and other New York State residents, since car ownership rates are so much lower in the City than elsewhere in the state.) For households outside of New York City, the average difference by immigration status was .25 cars per adult in the household. Using the difference between the rate of vehicle ownership per adult in each type of household and at each income level, FPI then estimates how many additional vehicles would be purchased if households including an unauthorized immigrant owned cars at the same rate as other immigrant households. FPI then reduced this estimate by half to adjust for an expected 50% take-up rate of license access based on the experience in states that expanded access previously, resulting in an estimate of 97,000 new cars being purchased and registered in New York State as a result of the new law, a 1% increase in the total number of registered cars. That’s an average of 35 cars per 100 newly licensed drivers in New York.

Applying these estimates to Virginia, TCI estimates that between 31,100 and 56,900 additional cars would be purchased or newly registered in Virginia within the first two years of expanded access.

Revenue associated with additional vehicles

TCI used current law (as of January 6, 2020) to estimate fee and tax revenue associated with the estimated increase in vehicles being titled and registered in Virginia. One-time fees include the title fee (a flat $15 fee) and the motor vehicle sales and use tax (based on car value with a minimum tax of $75), which is required for newly purchased vehicles and those brought into Virginia where the owner cannot show that sales and use tax was paid to another state. For this analysis, TCI has assumed the minimum $75 motor vehicle sales and use tax. Ongoing costs include license plate fees ($25 per car per year) and registration fees (varies slightly by vehicle type; this analysis assumes $40.75 per car per year, which is the minimum amount in current law).

In addition to the fee and tax revenue included in this analysis, additional cars being registered and titled in Virginia will result in an increase in local personal property tax revenue. Because that amount will vary depending on car value and local tax rates, TCI has not included this expected revenue in this analysis.