July 12, 2018

State K-12 Funding in Virginia: Incremental Progress and Opportunity for Long-Term Solutions

The budget deal struck by state lawmakers on May 30, 2018 was rightly celebrated for extending health care coverage to hundreds of thousands of Virginians, investing in mental health services and K-12 education, and boosting reserves that had been depleted during the recession. For K-12, this budget continued recent progress in restoring state support for schools by making investments in teacher pay and supplemental lottery funding. Yet this was not a “mission accomplished” moment for funding public education in the commonwealth – staffing and funding still lags pre-recession levels. Fortunately, federal actions have put Virginia in position to have the revenues to finally make these long-delayed investments and solve this funding crisis for the long term.

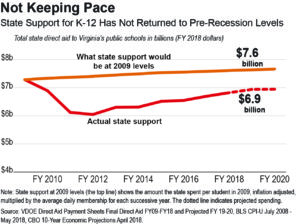

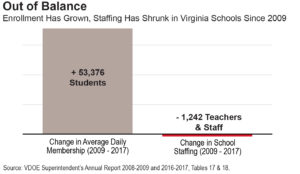

Even with recent progress, state support will be down 9.1 percent per student for the 2018-2019 school year in real dollars compared to 2008-2009 – the last year before the Great Recession started to impact K-12 funding. The lower levels of funding have forced many schools to cut back on instructors and school staff and we’re still down from where we used to be. Since 2009, staffing in Virginia schools has declined by 1,242 positions while enrollment has grown by more than 50,000 students. This means larger class sizes and fewer supports for students. At the same time, the needs of students have also been changing. The number of economically disadvantaged students has increased by almost 90,000 students since 2009 and English learners in Virginia schools have increased by over 54,000.

Virginia continues to disproportionately rely on local governments to fund public schools compared to other states – ranking in the middle of the pack in combined state and local spending per student, but in the bottom 25 percent of states (40th) in terms of state per pupil spending. These low levels of state funding have forced local governments to spend over twice as much as the state requires to meet the state’s Standards of Quality (SOQ) – spending $7.6 billion when the state requires $3.6 billion. Unfortunately, not all localities have the resources to make those additional investments, resulting in widespread disparities in the resources and opportunities available to students.

Localities lacking the resources to fill-in for state cuts have been forced to make many tough decisions in terms of staffing, programming, and school facilities. A review by the legislature’s research arm in 2015 found that more than 70 percent of Virginia school divisions now spend less per student to operate and maintain facilities than they did 10 years ago. Some spend up to 40 percent less per student. (See TCI reports Demonstrated Harm and Unequal Opportunities for more details on these disparities and examples of cutbacks).

The following highlights progress that was made in the 2018-2020 budget deal and what remains a work in progress.

The Good: What’s In the 2018-2020 Budget Deal for K-12

The state’s 2018-2020 budget includes the state share of a 3 percent pay increase for teachers and school staff starting July 1, 2019. According to a 2018 report by the National Education Association, Virginia trails teacher salaries nationally by 14 percent and enrollment in teacher preparation programs continues to decline. Add in that Virginia teachers earn about 70 cents on the dollar of non-teachers with similar age, education, and hours worked and you can see why lawmakers made this a priority.

The other major investment in K-12 was restoring a supplemental pool of lottery dollars back to its historic levels. When the public voted in 2000 to dedicate lottery revenues exclusively for public education, the state dedicated 40 percent of these revenues to supplement general aid going to schools with broad flexibility in how it could be spent – this is called the lottery per pupil allocation (lottery PPA). This funding pool guaranteed that a portion of lottery revenues would be used to boost support for public education, beyond general costs. During the recession, the state eliminated this pot of money and shifted lottery dollars to cover general education costs. In the budget signed during the 2018 legislative session, lawmakers continued progress made in the prior budget by fully restoring the lottery PPA back to 40 percent of total lottery revenues – adding a total of $73.9 million in general funds and $17.6 million in non-general funds into K-12 to boost the program.

Lawmakers also included many other smaller, yet important investments that include: $7.1 million more for Virginia’s At-Risk Add-On program that targets state support to schools with the highest concentrations of students eligible for free lunch to provide dropout prevention, after school programs, and specialized instruction; $4.6 million more in state support for the Virginia Preschool Initiative (VPI) that will help localities fill available preschool slots; $1.5 million more in support for teacher residency programs; and $1.5 million more for training teachers and school staff in positive behavioral interventions and supports (PBIS).

The Bad: What’s Missing for K-12

Similar to the 2017 legislative session, the 2018 legislature failed to act on new staffing recommendations sent to them by the Virginia Board of Education (Board). In October of 2016, the Board unanimously approved common-sense recommendations to undo some of the harmful cuts made during the recession and to ensure Virginia schools have adequate staffing for critical positions such as principals, assistant principals, school counselors, nurses, social workers, psychologists, and other support staff.

Lawmakers failed to address a single one of the Board’s recommendations for improving the SOQ that had a fiscal impact. This includes the House voting down bills to increase support for school nurses – which some schools have to share across buildings – and ignoring the governor’s proposal that every elementary school have state funding for a principal. Lawmakers also disregarded the Board’s advice to eliminate an arbitrary cap on the number of support staff the state helps pay for.

Virginians have shown willingness to do their part to pitch in and better fund schools. Once again, a 2018 poll conducted by VCU’s Commonwealth Education Policy Institute (CEPI) shows that a majority of Virginians are willing to pay higher taxes to increase school funding – as the poll also found the previous five years. An even higher percentage of Virginians are willing to pay extra to help schools with high percentages of low-income or special education students.

The Opportunities: Potential Support for K-12

If lawmakers take the right action, the state could finally have the revenues to make these vital investments. By conforming to federal tax changes passed in December 2017, Virginia is projected to bring in hundreds of millions of new state revenues. When lawmakers consider Virginia’s course of action, they should take into account the responsible approach of neighboring Maryland. Unlike Georgia, which is enacting tax giveaways to the rich who are already benefiting the most from the new federal tax law, Maryland is investing much of the revenues from the federal tax changes into K-12 education and other priorities.

And a Supreme Court ruling in June 2018 regarding online sales tax could also bolster potential revenues for Virginia. The decision allows states to tax online sales the same as brick-and-mortar shops which could bring in an additional $250-$300 million in revenues. This action would place online vendors on a similar playing field as brick-and-mortar shops instead of tilting it in their favor.

If lawmakers take advantage of these opportunities, they will have the resources to make the vital improvements that are needed to give students the opportunity to succeed in the classroom and beyond. A commitment to support our students and teachers is a commitment to the future of the commonwealth as a whole.